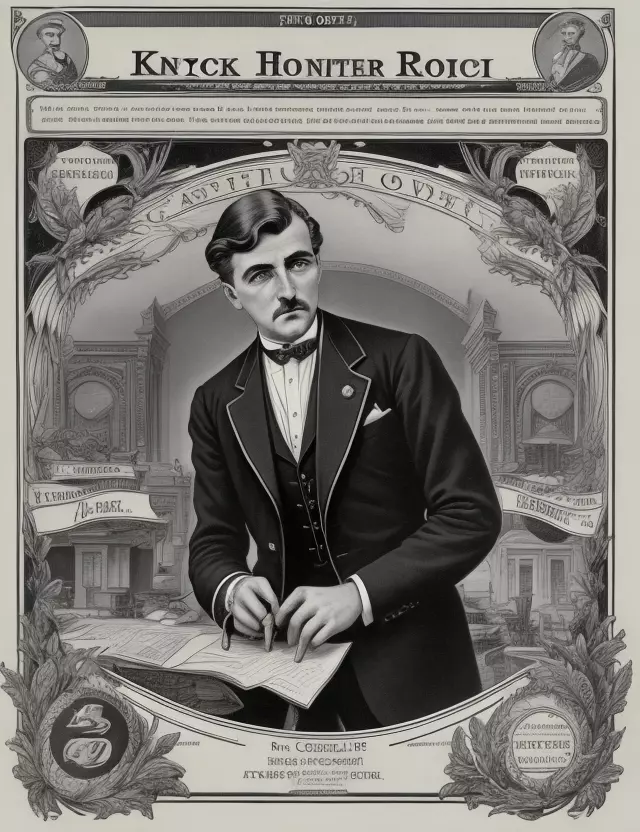

Panic of 1907: The Knickerbocker Trust Company Crisis and the Precipice of Financial Disaster

A Banking Panic that Shook the Foundations of the American Economy

On October 22, 1907, the Panic of 1907 reached its zenith when a run on deposits at the Knickerbocker Trust Company in New York triggered a mass financial crisis. This catastrophic event exposed the fragility of the American financial system and sent shockwaves through the economy.

The Early 20th Century Financial Landscape

The early 20th century was a time of dynamic economic growth in the United States. However, it was also marked by the emergence of financial trusts and a complex web of interconnected financial institutions.

Knickerbocker Trust Company: A Prominent Player

The Knickerbocker Trust Company was a prominent financial institution in New York City, serving as a symbol of the economic prosperity of the era.

The Run on Deposits

A series of events, including the bankruptcy of a leading brokerage firm and a rumor of insolvency at the Knickerbocker Trust Company, triggered a panic. Depositors began withdrawing their funds en masse, leading to a run on the bank.

The Domino Effect

The run on the Knickerbocker Trust Company had a cascading effect on other financial institutions. As trust companies were deeply interconnected, the crisis rapidly spread through the financial system.

Financial Titans Intervene

In a desperate attempt to quell the panic, major financial figures, including J.P. Morgan, stepped in to stabilize the situation. Morgan orchestrated efforts to provide liquidity to troubled institutions.

The Panic Subsides

Through the intervention of financial leaders and institutions, the panic gradually subsided. The Knickerbocker Trust Company was forced to close its doors, but a broader collapse of the financial system was averted.

The Aftermath

The Panic of 1907 highlighted the need for financial reform and regulation. It contributed to the establishment of the Federal Reserve System in 1913, which aimed to provide stability to the nation's banking and financial system.

Legacy and Lessons

The Panic of 1907 served as a harsh reminder of the inherent vulnerabilities in an unregulated financial system. It underscored the importance of a centralized mechanism to manage financial crises.

The Panic of 1907, epitomized by the run on the Knickerbocker Trust Company, was a pivotal moment in American financial history. It prompted significant reforms and set the stage for the creation of the Federal Reserve, a crucial institution for stabilizing the nation's economy in times of crisis.